The China Tech Recovery

Posted by Scott Mortenson on May 8, 2023

Navigating Regulatory Crackdowns and Embracing Emerging Technologies

China's tech industry has been at the center of global attention in recent years, with the country's rapid growth in digital innovation and entrepreneurship.

However, in 2021, the Chinese government launched a regulatory crackdown on the tech sector, leading to a significant downturn in the market. Those of us in fiber optic networking certainly felt the effects as the supply chain got squeezed.

Despite this setback, the industry has shown signs of resilience, with rebounding tech stocks and new opportunities in emerging technologies.

The Regulatory Crackdown and Its Impact

The Chinese government's regulatory crackdown on the tech industry began in late 2020, with the suspension of Ant Group's IPO, a major fintech company backed by Alibaba. Since then, the government has continued to implement new regulations, targeting tech giants such as Alibaba, Tencent, and Didi, among others. These regulations have been focused on issues such as data privacy, monopolistic practices, and antitrust violations.

The impact of these regulatory measures has been significant. The China Tech Index, which tracks the performance of the country's major tech stocks, fell by over 30% between February and August 2021.

The market value of some of China's largest tech companies took a hit, with their shares falling by more than 40% from their peak. This added to the supply chain shortages, with many relying on the optical network industry to search for alternatives.

Rebounding Tech Stocks

Despite the regulatory restrictions, there are signs that the Chinese tech industry is beginning to recover. The China Tech Index has rebounded by more than 20% since August 2021, indicating renewed investor confidence in the sector.

This rebound has been driven by a number of factors, including better-than-expected earnings from major tech companies, increasing demand for tech products and services, and a more stable regulatory environment.

New Opportunities in Emerging Technologies

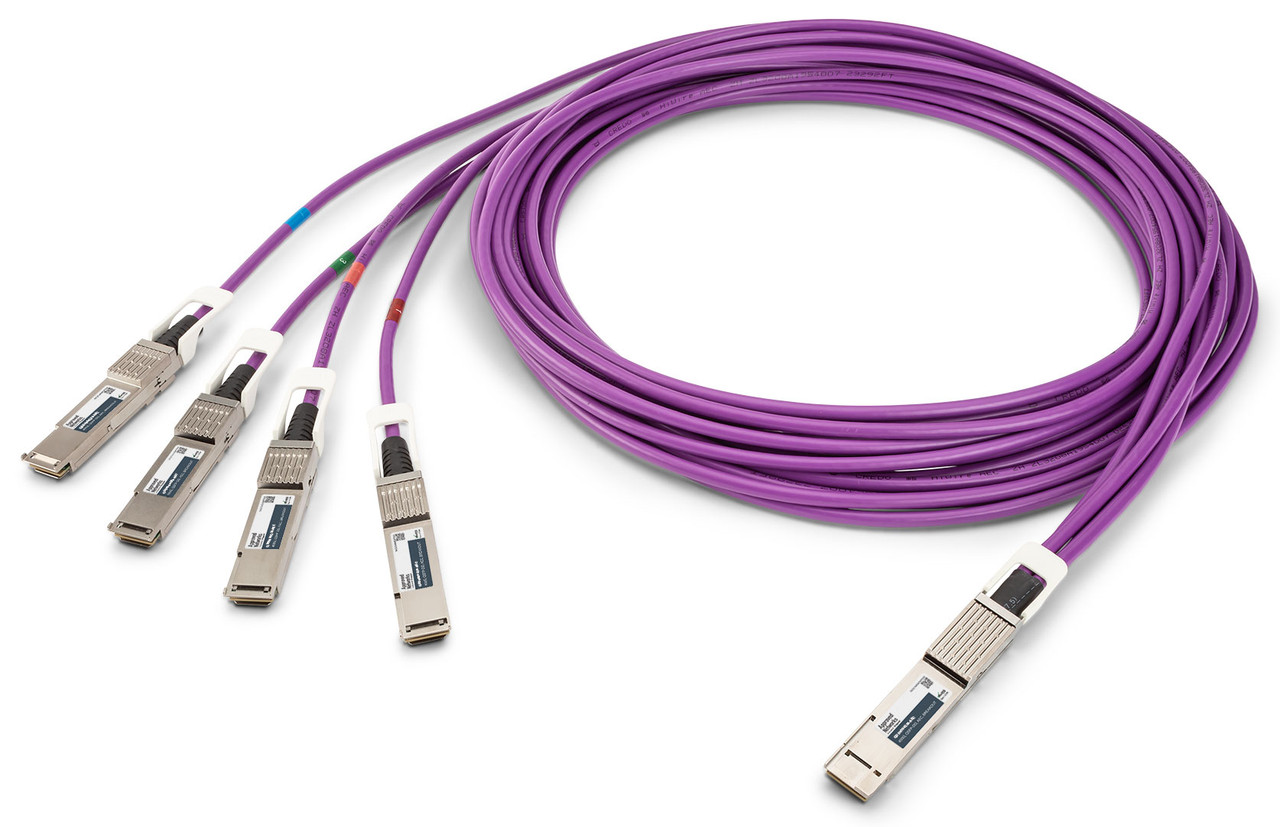

While the regulatory crackdown has had a significant impact on China's tech industry, including items such as transceivers, fiber optic cables and some passive equipment, it has also highlighted new opportunities in emerging technologies.

The Chinese government has signaled its intention to support the further development of artificial intelligence (AI), blockchain, and quantum computing, among others. This has led to a surge in investment, with some experts predicting that China could become a leader in these fields in the coming years.

The Future of the China Tech Industry

Despite the recent challenges faced by the China tech industry, many experts believe that it still has a bright future ahead. China remains the world's largest market for e-commerce, mobile payments, and gaming, and the country's massive population provides a huge market for tech companies to tap into.

Furthermore, the Chinese government's support for emerging technologies and innovation could help to drive the next wave of growth in the sector.

Will It Happen Again?

While it's impossible to predict the future, the short answer yes, it will happen again. Economies ebb and flow, and regulations are always popping up to influence the natural course of events, with change being the only constant.

The regulatory restrictions on China's tech industry have raised concerns among investors about the stability of the sector in the long term, and it's likely that the Chinese government will continue to implement new regulations and policies in the tech sector in order to maintain control and prevent potential risks.

It’s imperative for any business working with China to pay attention not only to what is going on now, but how it could — and probably will — affect the future. Big government economies are not only planning for the rest of the year, but next year as well. And if they feel the need for a course correction, they will take it . . . and it will change things for you, whether good or bad.

However, it looks as though the contortions and contractions of the last couple of years are, for now, stabilizing. Though we may not see a full recovery right away, the dynamic and evolving market is going in a direction of growth.